摘要:Bitcoin (BTC) miners sold more than 10,000 Bitcoin in a single day on Jan. 17, registering the largest daily decline in miner reserves in more than a year.。...

Bitcoin (BTC) miners sold more than 10,000 Bitcoin in a single day on Jan. 17, registering the largest daily decline in miner reserves in more than a year.

According to data from on-chain analytics provider CryptoQuant, Bitcoin miner reserves declined by 10,233 BTC on Jan. 17, equating to roughly $450 million in Bitcoin.

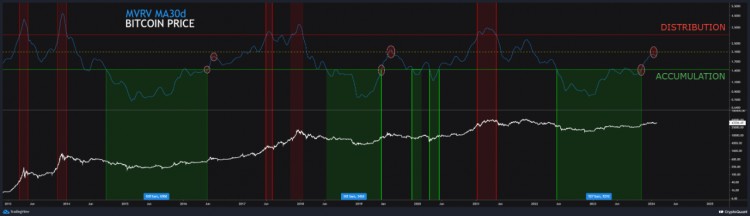

Miners typically go through phases of accumulation and selling. According to a Bitfinex report last year, miners began accumulating Bitcoin around mid-2023 when prices and profitability were lower.

When prices and profitability increase, such as in recent months, miners switch to a selling phase. Historically, miners sell coins to replenish cash flow or capture higher prices in a rally. The price of Bitcoin has been in the $42,000 to $43,000 range over the past few days.

The data also shows that Bitcoin miner reserves are at their lowest levels since July 2021 at 1.83 million coins. However, this is still a substantial stash valued at approximately $78 billion.

#Bitcoin Miners in Selling Mode: Recent on-chain data from @cryptoquant_com indicates a substantial increase in selling activity by #BTC miners. In just the last 24 hours, they've offloaded nearly 10,600 $BTC, valued at approximately $455.8 million! pic.twitter.com/JEtasWfR6N

— Ali (@ali_charts) January 17, 2024

Over the past 12 months, BTC miner reserves have declined by 22,800 BTC, but the total reserve figure has been relatively stable since early 2021.

On Jan. 15, the Bitcoin Miners’ Position Index (MPI) started to tick up, indicating that possible selling was imminent, according to CryptoQuant.

The MPI is the ratio of total miner outflow (USD) to its one-year moving average of total miner outflow (USD).

Related: Bitcoin halving 2024 — Miners predict potential outcomes of reduced BTC rewards

On Jan. 14, Cointelegraph reported that Bitcoin mining firms Riot, TeraWulf, and CleanSpark were the best-positioned to handle the significant cost increases expected following the BTC halving event in April or May.

Moreover, average hash rates have dropped to their lowest levels since October at around 400 exahashes per second (EH/s), according to Bitinfocharts.

Meanwhile, several large mining facilities in Texas have recently powered down some of their operations to secure energy for the state amid extreme cold weather, as reported by Cointelegraph.

HUGE: #Bitcoin hashrate plummets below 30 day average as #Bitcoin miners across the USA give back energy to balance the grid. pic.twitter.com/TFvoZpkYfX

— Dennis Porter (@Dennis_Porter_) January 18, 2024

Magazine: Crypto City: Guide to Austin