摘要:Thefourth-everBitcoinhalvingisdrivingoptimismofnewall-timehighsforBTC,accordingtoamarketstudyinvolvingnearly10,000cryptocurrencyinvestors...

The fourth-ever Bitcoin halving is driving optimism of new all-time highs for BTC, according to a market study involving nearly 10,000 cryptocurrency investors.

Data from a survey focused on investor sentiment and anticipation of Bitcoin’s next mining reward halving by cryptocurrency exchange Bitget reflects investor confidence around the highly-anticipated event.

Results shared with Cointelegraph outline key findings of the study and its methodology, which aimed to draw from a representative sample of cryptocurrency investors worldwide. A range of demographics was covered, with participants hailing from countries in Western and Eastern Europe, South and South East Asia, MENA and Latin American regions.

Related: $100K BTC? Don’t undervalue Bitcoin ETF influence, says Adam Back

9748 participants participated in the study between November and December 2023, with the data anonymized for analysis.

84% of participants expect Bitcoin to surpass the 2021 bull market all-time high of $69,000. East Europe respondents were the least bullish on this outcome at a regional level, with 75% of respondents voting yes to BTC potentially surpassing its previous record.

Investors from Western European countries were the most optimistic about the next price top for Bitcoin, with 41% of respondents expecting BTC to surpass the $100,000 mark. However, the report notes that investors from the region were less convicted about the Bitcoin halving impact BTC price:

“It may indicate that these investors are 'short-term cautious, long-term optimistic,' as some Western European investors do not believe the Bitcoin halving will trigger a new bull market.”

Meanwhile Latin America, East Asia, and South East Asia respondents were the most optimistic that the Bitcoin halving would significantly impact BTC price. 84%, 82%, and 81% of respondents from the regions above foresee a substantial impact of the mining reward halving.

In an interview with Cointelegraph on Jan.30 , Bitcoin proponent Paul Sztorc offered a contrasting view of the impact of the Bitcoin halving, suggesting the event would be a litmus test for the mining industry in particular as rewards drop while hash rate and mining difficulty continues to reach new highs.

Related: Bitcoin halving 2024 — Miners predict potential outcomes of reduced BTC rewards

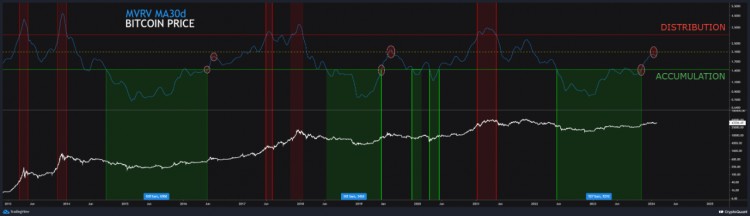

Sztorc suggests that the initial impact on price might not be as pronounced as some commentators predict. Fellow Bitcoin proponent and cryptographer Adam Back told Cointelegraph that the next Bitcoin peak may come 18 months after the next halving in an interview in Dec. 2023.

Several prominent mining companies gave in-depth predictions in about the impact of the halving on their operations and the need to be highly efficient to remain profitable in one of Cointelegraph's 2024 New Year Specials.

Magazine: Big Questions: How can Bitcoin payments stage a comeback?