摘要:The newly launched spot Bitcoin exchange-traded funds (ETFs) have seen inflows totaling $1.4 billion in the first two tr...

The newly launched spot Bitcoin exchange-traded funds (ETFs) have seen inflows totaling $1.4 billion in the first two trading sessions, according to Bloomberg ETF analyst Eric Balchunas.

A total of 500,000 trades were made on the funds, totaling a trading volume of $3.6 billion, according to data from Bloomberg. Trading volume considers the outflows and inflows from the funds. Balchunas suggested the numbers may be adjusted due to transactions awaiting accounting settlement.

LATEST: With two days in the books, the Nine Newborns have taken in +$1.4b in new cash, overwhelming $GBTC's -$579m of outflows for net total of +$819m. $IBIT now leading pack w/ half a bil, Fidelity close second tho. The newborns' $3.6b in trading volume on 500k indiv trades… pic.twitter.com/b7U5DjENaw

— Eric Balchunas (@EricBalchunas) January 13, 2024

The data reveals Grayscale's ETF, the Grayscale Bitcoin Trust (GBTC), experienced an outflow of $579 million during the period. After deducting the outflows from GBTC, the net total inflows across the products stood at $819 million. The funds' initial activity is so far aligned with previous predictions from ETF analyst James Seyffart, who believes Bitcoin ETFs could attract around $10 billion in the first year.

Grayscale’s GBTC outflows could be explained by holders converting shares after redemption was opened this week when the U.S. Securities and Exchange Commission granted the ETFs approval through a ruling change. SkyBridge Capital founder Anthony Scaramucci told Bloomberg that some GBTC holders are booking losses and switching to lower fee options.

GBTC is one of the largest holders of Bitcoin (BTC), managing over $27 billion worth of the cryptocurrency as per data from the blockchain analytics platform Arkham Intelligence. Shares of GBTC have been traded since 2013 but were not redeemable for Bitcoin until Jan. 1.

On the top of this week's performance was BlackRock's iShares Bitcoin Trust (IBIT) with $497.7 million total flows, followed by Fidelity Advantage Bitcoin ETF (FBTC) amassing $422.3 million and Bitwise (BITB) attracting $237.9 million.

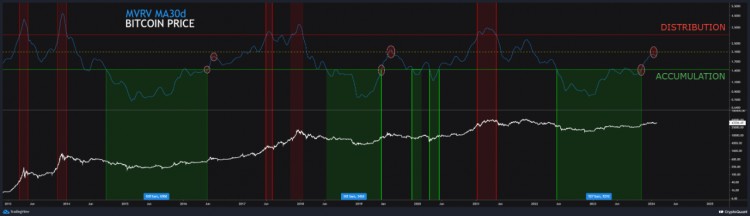

After a 75% rally in the 90 days leading up to ETFs approval, Bitcoin price experienced a 6.8% decline between Jan. 11 and Jan. 12, confirming bears’ theory of a sell-the-news-style event following the SEC green light, according to Cointelegraph's market analysis. The cryptocurrency trades at $42,856 at the time of writing, a 0.77% decline over the past 24 hours.

Magazine: How to protect your crypto in a volatile market — Bitcoin OGs and experts weigh in