摘要:Source:TradingViewBlackRockCEO"seesvalue"inEthereumETFDatafromCointelegraphMarketsProandTradingViewshowsETH/BTCrisingfromyearlylowsof00478onJan...

Ether (ETH) has gained more than 20% against Bitcoin (BTC) in 72 hours and traders see further upside to come.

BlackRock CEO "sees value" in Ethereum ETF

Data from Cointelegraph Markets Pro and TradingView shows ETH/BTC rising from yearly lows of 0.0478 on Jan. 9 to hit 0.0587 on the day.

ETH/USD is also busy breaking out, seeing levels absent from the chart since mid-2022.

Against Bitcoin, a bullish divergence on the moving average convergence divergence (MACD) indicator on weekly timeframes is currently a topic of interest for popular traders.

Well well, seems that the trolls out there are quiet now that they realize that weekly bullish div. is playing out.

— Wolf (@IamCryptoWolf) January 12, 2024

Note also the weekly MACD bullish crossover. $ETHBTC https://t.co/dlPyY3Yobc pic.twitter.com/IXjsXT0fL8

The largest altcoin joins several other large-cap tokens in beating Bitcoin’s returns this week — even as the latter celebrates the United States launch of spot exchange-traded funds (ETFs).

Thus, Ether’s turnaround threatens to leave Bitcoin in the shade, as Cointelegraph reported, despite BTC/USD hitting its highest levels since the December 2021 post-ETF announcement.

Buzz around ETH getting its own U.S. ETF debut later in the year appeared to drive bullish momentum.

Larry Fink, CEO of asset manager BlackRock which this week released its Bitcoin ETF, told CNBC on the day that he “sees value” in a copycat move for Ether.

“Larry Fink is already beating the Ethereum drum. One day after the Bitcoin launch,” trader, analyst and podcast host Scott Melker, known as “The Wolf of All Streets,” responded on X (formerly Twitter).

“The rotation is real.”

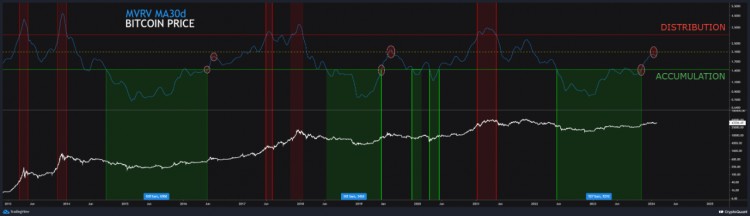

Analyst: Bitcoin dominance "looks topped out"

Considering what might come next, Michaël van de Poppe, founder and CEO of trading firm MNTrading, saw Ether continuing to gain ground against Bitcoin as a part of the combined cryptocurrency market cap.

Related: Here’s what happened in crypto today

“The Bitcoin dominance looks topped out prior to the Bitcoin halving,” he told X subscribers.

“Expecting to see a continuation as Ethereum is taking more momentum. This might be the cycle's high on the Dominance as the altcoin bull market has started."

Van de Poppe suggested that attention may thus focus away from BTC/USD until after the block subsidy halving in April — itself known as a price catalyst, albeit not an immediate one.

Meanwhile, part of the ETF narrative envisages a major Bitcoin supply squeeze as institutions seek exposure to BTC in the long run.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.