摘要:Nowstandingat$91trillion,thisstonearoundtheneckofglobaleconomiesiscontinuingtoputpressureonfiatcurrenciesandbondmarketsallovertheworld,withtheIMFincreasinglycitingconcernsaboutpublicdebtsustainability...

Regardless of any short-term pullback, Bitcoin will spend this year further cementing its reputation as digital gold. Indeed, just as it did in March 2023 during a narrowly avoided banking crisis, BTC will likely hold up in ways many traditional assets — perhaps even gold — fail to.

It is true that the grand institutional entry into Bitcoin has not lit up the markets as some might have hoped, and it probably won’t for a while yet. Much of this event was already baked into prices and there are few investors that saw the SEC's reluctant capitulation as any kind of ringing endorsement of cryptocurrency.

Related: An Ethereum ETF is coming sooner than you expect

Nonetheless, BlackRock's ETF has already hoovered up $2 billion in assets as others follow fast in the rear, providing a level of support never before seen for the world’s biggest digital currency. The day is soon coming, infact, that we all reminisce about the good old days of BTC volatility.

In the meantime, though, we will almost certainly see a pullback in the face of global economic pressures. Chief among these is the resurgence of inflation in the US, which has dashed hopes for a rate cut before Q2, and which will likely continue to be exacerbated by rising tensions in the Middle East and an ongoing war in Europe.

On top of this, we have the end of the Bank Term Funding Program (BTFP) coming up on March 11. The saving grace of U.S. banks during last year’s almost-crisis, this may well reveal some further shaky foundations that could again spook markets into a significant sell-off.

Even more significant than all this, though, we have a growing global sovereign debt pile. Now standing at $91 trillion, this stone around the neck of global economies is continuing to put pressure on fiat currencies and bond markets all over the world, with the IMF increasingly citing concerns about public debt sustainability.

While Bitcoin may initially wobble with global markets in the face of these pressures, though, as a finite resource that is transparent, immutable and decentralized, its long-term concept value will continue to grow and this will support prices in the medium to long term. In-fact this year we could truly see Bitcoin become a North Star for the global economy — if not in exactly the way the Bitcoin maxis had hoped.

Ultimately, however, we are unlikely to see any major Black Swan economic events this year. Not only are we facing a presidential election in the U.S., but several others across the world — with seven out of 10 of the world’s most populous nations (equating to around half the global population) hitting the polls over the next 10 months.

Related: 3 bull market narratives for 2024 that you haven’t heard about yet

As such, while there isn’t the economic wriggle room to offer the rate cuts and huge spending sprees that many politicians might like, we can bank on policymakers pulling out all the stops to avert any kind of crisis — especially in the banking sector. In the U.S., we will see some new packages to support banks while the real estate market will also likely win some attention.

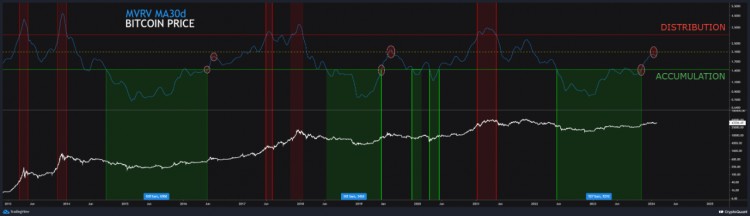

As such, we won’t see Bitcoin — or indeed any market — staying down for very long this year. Rather, after an initial pullback on global economic concerns and some reserved trading around sustained interest rates, we will — in my personal opinion — see BTC rebound and surpass $50,000 in the second quarter before taking off into the oncoming bull market.

Prices and sentiment have been subdued for too long and risk appetite has returned to crypto, if not global markets at large. And if all those politicians want to win any votes, they will need to make sure that it stays that way.

Stefan Rust is the CEO of Truflation.com, which tracks real-time data across networks, markets, and feeds to provide financial and economic data on-chain. He served previously as the CEO of Bitcoin.com. He got into crypto in April 2012 before expanding his investment and advisory portfolio across the entire blockchain industry.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.